Survey: Overwhelming Public Support for Small Businesses to Offer Cost-Saving “Large Company” Health Plans

Vast majority supports arrangement even in states where Democratic attorneys general have sued in an effort to prevent small businesses from offering large company health plans

In June of 2018, the Department of Labor updated its regulation for association health plans making it easier for small businesses to band together and offer the same type of health insurance to their own employees as is already used by large companies. Large company health insurance is typically less expensive than small group health plans and individually purchased health plans. As noted by the National Conference for State Legislatures, “Small businesses often pay more for employee health benefits because they don’t have the buying power of big employers. On average, small businesses paid about eight to 18 percent more than large firms for the same health insurance policy.”[i] The new association health plan regulation opens large company insurance savings not only to small businesses with fewer employees but also to sole proprietors and self-employed within the gig economy.

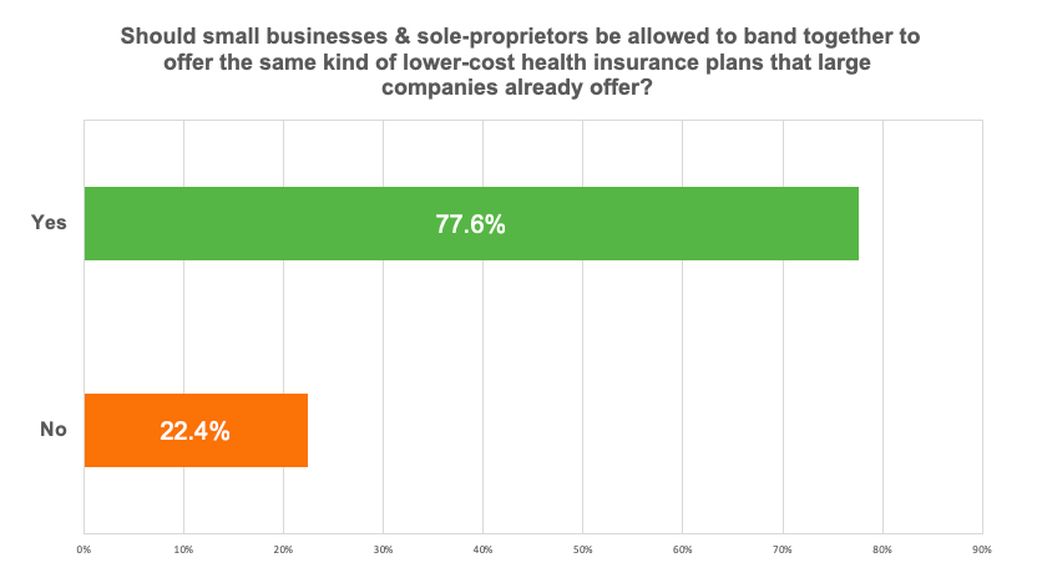

AssociationHealthPlans.com surveyed over 1,100 adults across the nation to assess public opinion on the central objective behind the new regulation: permitting small businesses to pool their employees together in order to access the savings associated with a single large company health insurance plan. The survey was performed at the beginning of this month and asked, “Should small businesses & sole-proprietors be allowed to band together to offer the same kind of lower-cost health insurance plans that large companies already offer?” Respondents could select either “yes” or “no” as answers, and the display order of the two options was randomized across respondents. Respondents were limited to U.S. adults that generally aligned with three basic US demographic trends (age, gender, and geographical region).

The nationwide survey found overwhelming public support for small businesses collaborating together to offer large company health insurance plans. In fact, 77.6 percent of survey respondents answered “yes” in response to the question, “Should small businesses & sole-proprietors be allowed to band together to offer the same kind of lower-cost health insurance plans that large companies already offer?” Support for small business offering large company health insurance plans was over three times higher than those that opposed the proposition (77.6 percent “yes” to 22.4 percent “no”).

While public opposition to small businesses banding together to offer large company health plans is limited (roughly one-in-five survey respondents disapproved), political opposition to the measure is more pronounced. Inasmuch as the new regulation was issued through the advocacy and support of a Republican administration, it attracted criticism from a dozen Democratic attorneys general. These attorneys general, from 11 states and the District of Columbia, filed a lawsuit[ii] in 2018 that seeks to invalidate the new association health plan regulation that made it easier for small businesses and sole proprietors to band together and create the same type of health insurance coverage used by large companies. However, the results of the survey found not only is there overwhelming support for small businesses offering large company health plans at the national level, but also the same level of support was observed in the states participating in the lawsuit. Moreover, the level of support among survey respondents in the states (and D.C.) filing the lawsuit was, on average, slightly higher than the already high national average (78.6 percent for the eleven states and D.C. versus 77.6 percent for the nation as a whole). It is also important to note that survey respondents from the 11 states and D.C. represented approximately 35 percent of total survey respondents because of the sizable populations in several of the lawsuit states.

CONCLUSION

The results of this national survey provide very encouraging news to advocates of new association health plan regulation and, perhaps, some frustration to its critics. While unaddressed by the survey itself, part of the public support observed in the survey may derive from a desire for fundamental fairness between small businesses and large businesses. For decades, big companies have lowered costs by using “large group” health plans to insure tens of millions of employees. Previously, small businesses and entrepreneurs paid more for health plans even when the benefits were similar to large group plans because small businesses lacked the buying power represented by a large pool of health plan enrollees. This, in turn, burdened smaller businesses with higher overhead costs for health coverage than their large company counterparts. The new ability for small businesses and the self-employed to access large company health insurance will place them on more equal footing with large companies with respect to health costs.

AUTHOR

Kev Coleman is a widely recognized authority on American health insurance markets and is also the President of AssociationHealthPlans.com. Press inquiries regarding this report can be directed to Mr. Coleman at media@afmcommunications.com. Data from the report may be cited with proper attribution. © Kevin Coleman.

METHODOLOGY

Report data is based on 1,119 responses to a nationwide survey conducted from January 2, 2019 to January 4, 2019. The single-question survey asked respondents, “Should small businesses & sole-proprietors be allowed to band together to offer the same kind of lower-cost health insurance plans that large companies already offer?” Respondents had the option of selecting one of two answer options: “Yes” and “No.” Answer options for the survey question were displayed in randomized order across respondents.

The survey was displayed to adults located in the United States through a network of news and other content sites. Demographic inferencing and methodology to acquire survey respondents who approximate U.S. Census Bureau’s Current Population Survey (CPS) Internet Supplement statistics on age, gender, and geographical region was performed by Google-administered technology. Race, education, income, and other demographic factors were not examined. Margin of error across survey responses is estimated at +2.2%/-2.2%.

[i] National Conference for State Legislatures. “Small and Large Business Health Insurance: State & Federal Roles.” NCSL.org. (September 12, 2018). http://www.ncsl.org/research/health/small-business-health-insurance.aspx. Last visited January 3, 2019.

[ii] Harris Meyer. “Democratic Attorneys General Sue to Block Association Health Plan Rule.” Modern Healthcare. (July 26, 2018). https://www.modernhealthcare.com/article/20180726/NEWS/180729919. Last accessed January 7, 2019.