Working Owners & AHPs Explained

What Is a “Working Owner” in an Association Health Plan?

Qualifications & Rules

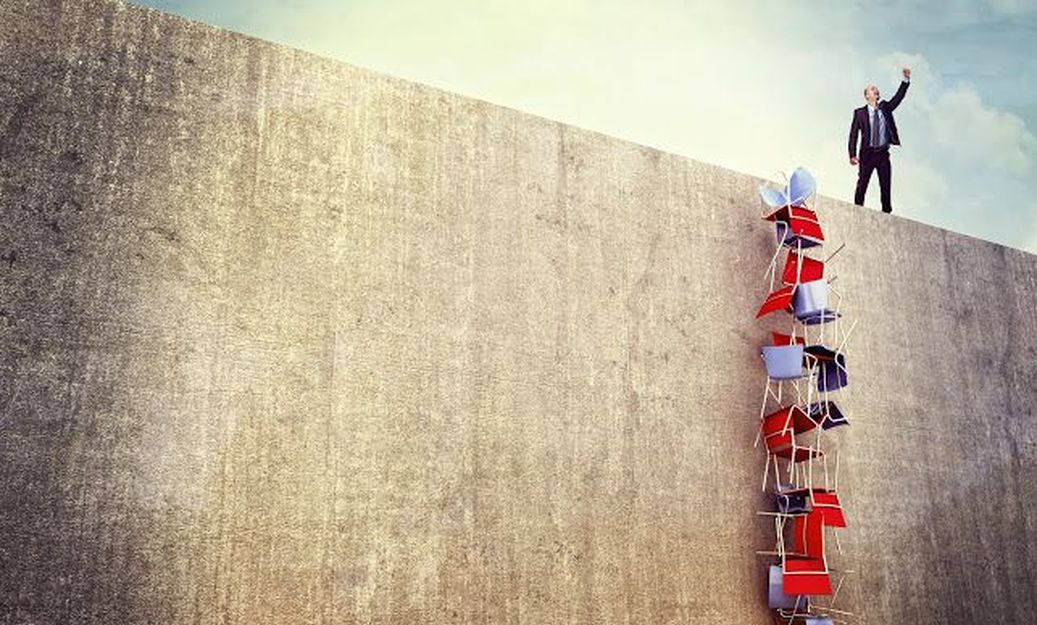

The recent change to association health insurance regulation has opened up these plans to individuals. Previously, people who worked alone as contractors, freelancers, sole proprietors, and other forms of unincorporated or incorporated professions were often restricted to “individual and family” health insurance. This market, since 2014, is now known as the “Obamacare” or “Affordable Care Act” market. If an individual did not qualify for subsidies, health insurance could be extremely expensive.

The recent regulatory change to association health plans has made this group health insurance market available to the self-employed. Self-employed, in this context, includes people with an ownership right in a business activity, regardless of whether the business activity is incorporated or unincorporated. This means that work activity as informal as tutoring or giving piano lessons could potentially qualify someone for association health coverage.

The new regulation refers to individuals who may participate in association health plans as “working owners.” Working owners function both as an employer (since association membership is open to employers) and an employee who may participate within the association health plan. The lack of formality associated with qualifying business activity means work that lacks incorporation (e.g. handyman work, realtor, etc.) still has the potential to allow an individual to join an association so long as the below conditions are satisfied.

In order to qualify as a “working owner” to become a member within an association, a person must earn wages from their work AND meet one of the following criteria:

- Work for an average of 20 hours a week or 80 hours a month as a sole proprietor or self-employed individual

- These hours can be totaled across multiple clients or activities (e.g. different customers for a handyman or different ride-share companies for an on-demand driver)

- Earn at least as much as the price of the association health plan coverage for the working owner and any beneficiaries included in the coverage

It is important to note that hours worked as sole proprietor or self-employed are not required to be full-time or exclusive. An individual can have another job that is unrelated to the work that qualifies her or him for association health coverage.

A qualified working owner may participate in an association and its health coverage. The association is expected to periodically confirm a working owner’s eligibility. Regarding the periodic confirmation of working owner eligibility, the Department of Labor has stated:

“For instance, in the Department’s view, a reasonable determination could involve the fiduciary relying on the accuracy of the information in written documentation or a sworn statement submitted by a working owner, without independent verification, unless something in the written document or sworn statement, or other knowledge of the fiduciary, would cause a reasonable fiduciary to question the accuracy or completeness of the documentation. Nothing in the final rule precludes groups or associations sponsoring AHPs from establishing their own, separate verification processes and requirements for working owners, or any employer or employee, as a condition of membership in the group or association. Similarly, health insurance issuers doing business with AHPs could establish a verification and monitoring requirement as part of the insurance policy or an administrative service arrangement with the AHP.”